kwsp i akaun member investment

Cara untuk melabur di i-Invest KWSP. I-Invest adalah Skim Pelaburan Ahli yang memberikan pilihan dan fleksibiliti kepada pencarum KWSP untuk mempelbagaikan portfolio dan meningkatkan simpanan persaraan.

Investment On Kwsp I Invest The Research Files

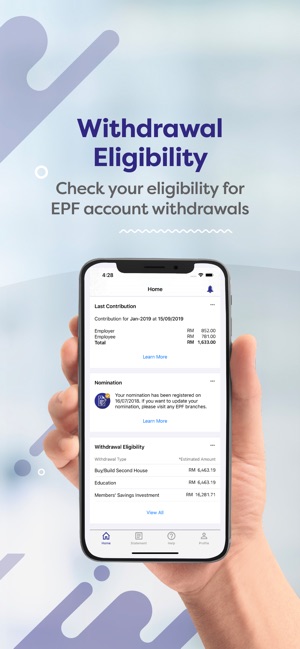

Applications for such withdrawal can be made through i-Akaun Member.

. Jika anda sudah ada sila ikuti langkah-langkah berikut. I-AKAUN MEMBER i-AKAUN EMPLOYER i-AKAUN BUSINESS PARTNERS Add to your retirement savings with ease through the i-Akaun app. Please refer to Age 5560 Withdrawal Brochure.

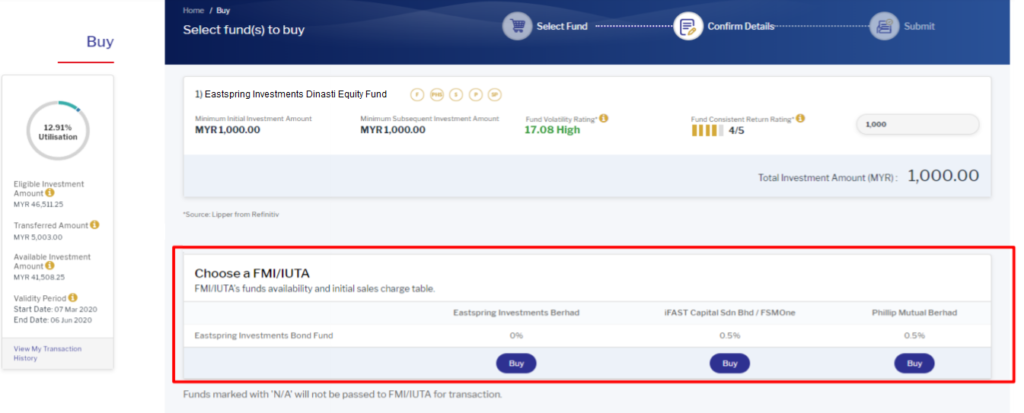

Jika anda sudah memenuhi kelayakan dan kelayakan minimum caruman anda sudah boleh melabur melalui i-Invest. 22 rows No upfront fees will be imposed by FMI for investments transacted through i-Invest via EPF i-Akaun while for investments made through agents the upfront fee will be reduced from a maximum of 3 to a maximum of 15. Siapa Yang Boleh Memohon Syarat-syarat kelayakan Warganegara Malaysia ATAU.

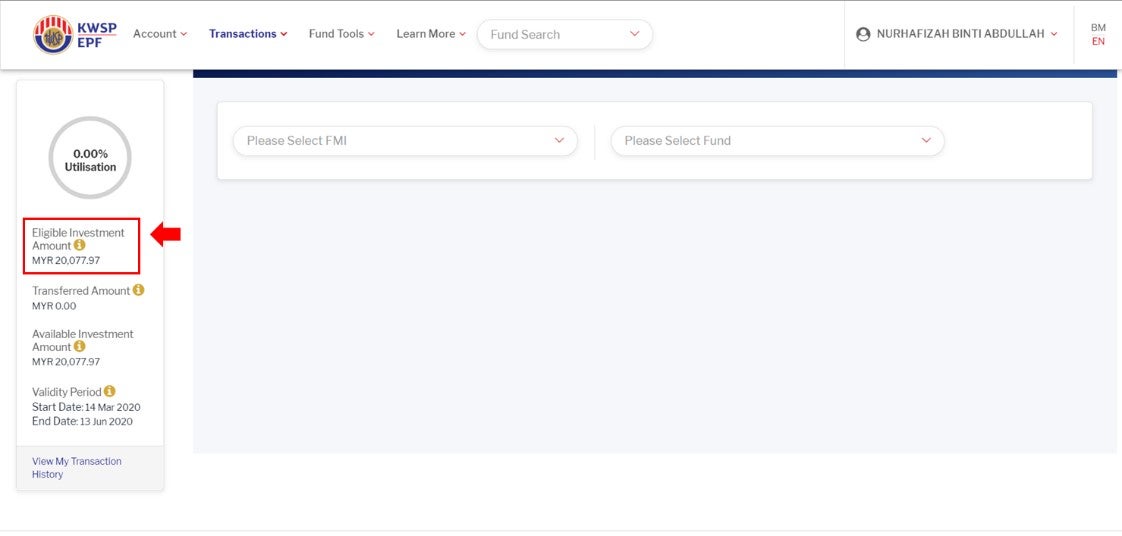

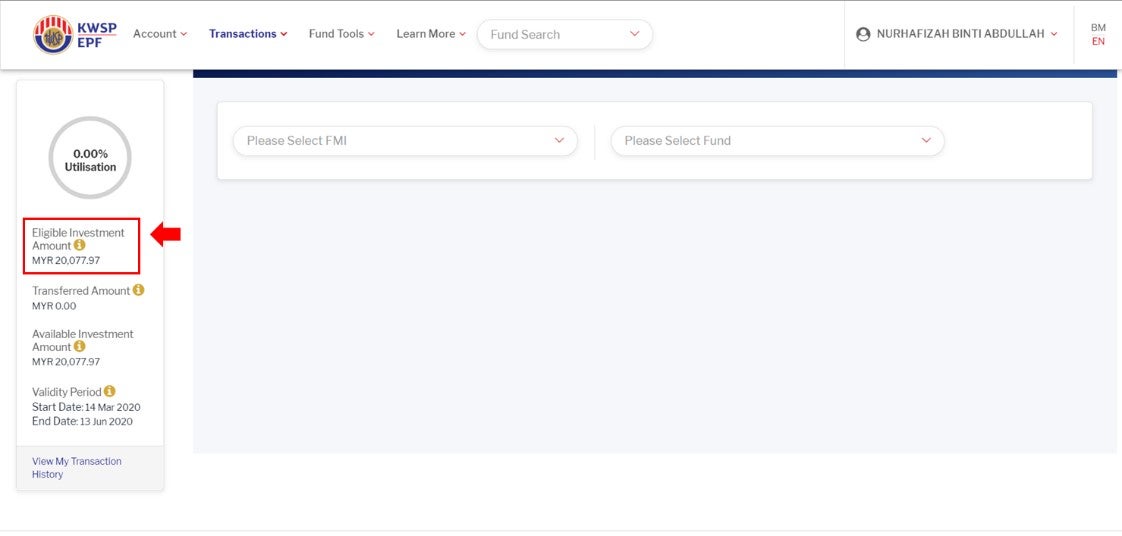

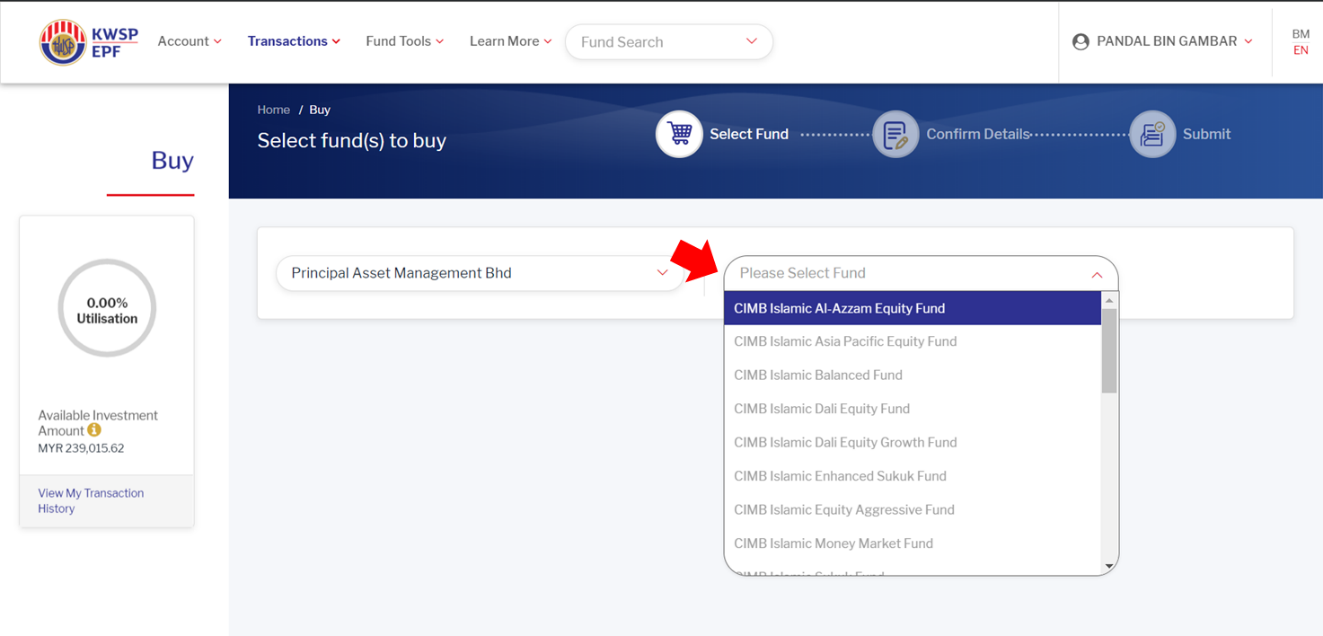

A few days ago the Employees Provident Fund EPF has launched its i-Invest platform which allows its members to invest in unit trust funds with their EPF savings. I-Invest is an online self-service platform launched by the Malaysian Employees Provident Fund Board KWSP that allows members to use their First Account Akaun 1 deposits to invest. Mobile team near you.

The great thing about this platform is that it is almost zero cost. Cara Daftar i-Akaun di Kios KWSP Lokasi Kios Pihak Ketiga 2. EPF i-Invest melalui i-Akaun 1.

Mobile team berdekatan anda. Who Can Apply Requirements Malaysians OR Permanent Residents PR OR. The KWSP has added a new feature to the i-Akaun APP and members can now directly contribute to the EPF through i-Akaun in an effort to persuade the public to contribute more to the provident fund.

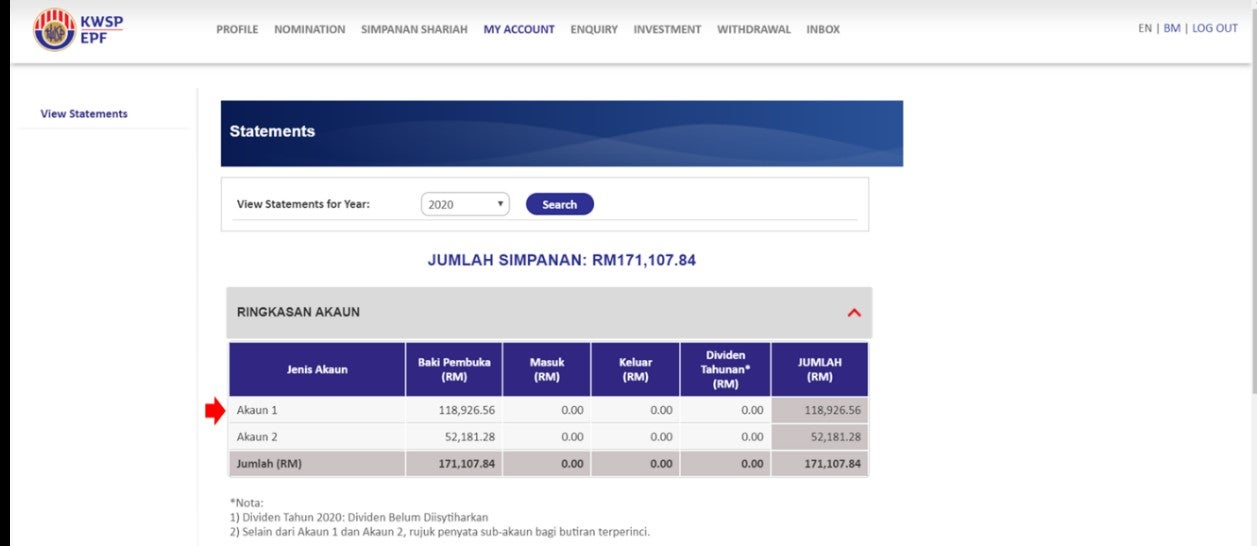

Apakah itu Pelaburan i-Akaun KWSP. TA Islamic CashPLUS Fund TAICP 5643 5150 1744. I-Akaun Member user Have a balance in EPF account Types of Protection Offered Life protection Critical illness protection Key Features of i-Lindung Seamless journey The simplest way to purchase protection products with no medical check-up required Quick quotation Get a quotation online for all products offered Information centre.

Ini adalah kemudahan dalam talian yang membolehkan anda mengeluarkan dana yang layak daripada Akaun Simpanan KWSP anda dari Akaun 1 untuk membuat pelaburan iaitu belian ke dalam unit amanah. KWSP i-Invest self-service investment tool has added a new feature that allows members to view the performance of their investment returns over time. Experience the new i-Akaun mobile application for faster and easier access to your EPF account anytime anywhere.

Members aged 55 years and abve have the option to invest part of the saving in Akaun by making Age 5560 Withdrawal Investment. Kalau belum boleh tengok cara daftar i-Akaun KWSP Online di sini. The Employees Contribution Rate Reverts to 11 More Info.

Transaksi boleh dihantar melalui platform dalam talian ini termasuk pelaburan iaitu. I-akaun member i-akaun employer i-akaun business partners. This withdrawal is not part of the Members Investment Scheme.

TAIM TRUST AC COLLECTION. Setelah permohonan diluluskan pembayaran kepada SIT tidak akan dilakukan serta-merta dan mungkin. EPF Kwasa Damansara Branch officially opens to the public from 4 JULY 2022 More Info.

Ways To Register Automatic Counter Employer i-Akaun Kiosk IMPORTANT REMINDER. I-akaun member i-akaun employer i-akaun business partners. TAIM CLIENTS TRUST AC - TAICPF.

Members could previously only pay provident money using the banks online banking system. Sebelum itu pastikan anda sudah mempunyai i-Akaun KWSP. Cara Permohonan i-Lindung KWSP.

With this platform members can invest with a sales charge ranging from 0 to a maximum of. Pelaburan yang dilaksanakan melalui i-Invest dalam i-Akaun Ahli tidak akan dikenakan sebarang caj jualan oleh IPD manakala pelaburan yang dilaksanakan melalui ejen akan dikenakan caj yang dikurangkan dari sehingga 3 kepada sehingga 15 sahaja oleh IPD. Log masuk ke i-Akaun Ahli klik pada tab i-Lindung pilih produk yang ditawarkan oleh SIT lengkapkan maklumat di portal SIT kebenaran untuk potongan dari Akaun KWSP penerimaan penyata maklumat dari SIT.

Melalui i-Invest ahli yang mempunyai simpanan secukupnya boleh memindahkan sebahagian dari dana dalam Akaun 1 untuk dilaburkan melalui Institusi-institusi Pengurusan Dana IPD. Become A Member Choose Your Savings Register Activate i-Akaun Become A Member There are the various ways that you may register to be an EPF member. That is why the EPF Act 1991 mandates employees to register as a member and contribute to their own savings.

TA Global Technology Fund TAGTF which are denominated in USD AUD SGD EUR and RMB. Frequently Asked Question FAQ i-Akaun Member Login USER ID. Frequently Asked Question FAQ i-Akaun Member Login USER ID.

Please enter your details. Instalment Plan More Info. I-akaun member i-akaun employer i-akaun business partners.

Epf How To Apply For Epf I Invest Mypf My

General Information Epf I Invest Via I Akaun Principal Asset Management

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf I Invest Features You May Not Know About

Investment On Kwsp I Invest The Research Files

Epf I Invest Features You May Not Know About

Epf I Invest Features You May Not Know About

Epf How To Apply For Epf I Invest Mypf My

Ahmad Sanusi Husain Com Investing How To Plan Malaysia

Bernama On Twitter Epf I Invest Online Platform Enables Unit Trust Investment Directly From Epf Account Https T Co Ld4hsudysn Https T Co 7aqbflb4dk Twitter

Opening Of Investment Account Performing Initial Investment With Principal Principal Asset Management

0 Response to "kwsp i akaun member investment"

Post a Comment